Banking on Trust

Building Strong Banking Relationships Based on Trust

Building Strong Banking Relationships Based on Trust

With a few high-profile closings, the news has been abuzz with announcements of struggling financial institutions and much talk about challenges to our banking system. To make matters worse, opportunistic enterprises are hammering the phones and email to sow seeds of doubt and fear, hoping that you’ll jump on their latest ‘amazing’ offer.

Are Things as Challenging as They Say?

Is the outlook as stormy as the media would portray? In a word, no. Would it be prudent to pause and examine your options when it comes to making smart banking decisions? Certainly!

First, comes the understanding that all banks are not created equal. Community banks, like Primary Bank, operate quite differently than the institutions you’ve been reading about. Here’s why, Primary focuses on deploying deposits and capital to support local businesses and we limit our investments in securities, municipalities, government bonds or corporate preferred stock.

Community Banks are Different

Primary Bank is a community bank, which means we are committed to supporting the banking needs in our surrounding cities and towns. Deposits at Primary Bank fund the local businesses that employ our neighbors, provide the services that support our communities and drive the economic engine of New Hampshire.

We deliver expertise based on first-hand knowledge of the business climate here, propelling investment in the future of our State.

Most importantly, Primary Bank builds relationships based on trust. That trust begins with the Primary Bank promise:

- We will always work to perpetuate a culture that encourages small business success.

- We start with ‘yes’ and go to great lengths to support the needs of the business community.

- We will always be innovative in client services.

Our commitment is carried further in the way we build our client relationships. Clients can expect a true partnership in Primary Bank. We are committed to creating the best banking relationships, always trying to exceed our clients’ expectations, delivering expert knowledge, and providing the financial resources to help you and your business succeed.

Can You Determine the Health of Your Bank?

The FDIC and NCUA each publish the raw financial numbers for each institution every quarter. This information can be found at ffiec.gov/reports.htm. Below are a few of the data points that are commonly used to compare institutions.

- Texas Ratio

Developed at RBC Capital Markets, the Texas Ratio is a relatively straightforward and effective way to determine the overall credit troubles experienced by financial institutions. It is determined by comparing the total value of at-risk loans to the total value of funds the bank has on hand to cover these loans.

- Deposit Growth

You can also examine the amount of total deposits in a bank and chart whether they have been increasing over time. A strong track record of stable growth is an indicator of consumer confidence and the bank's ability to strengthen its balance sheet.

- Capitalization

Another quick, at-a-glance indicator of bank financial health is its available capital. Stronger capital means that more assets are available to cover potential losses.

Healthiest Bank in New Hampshire

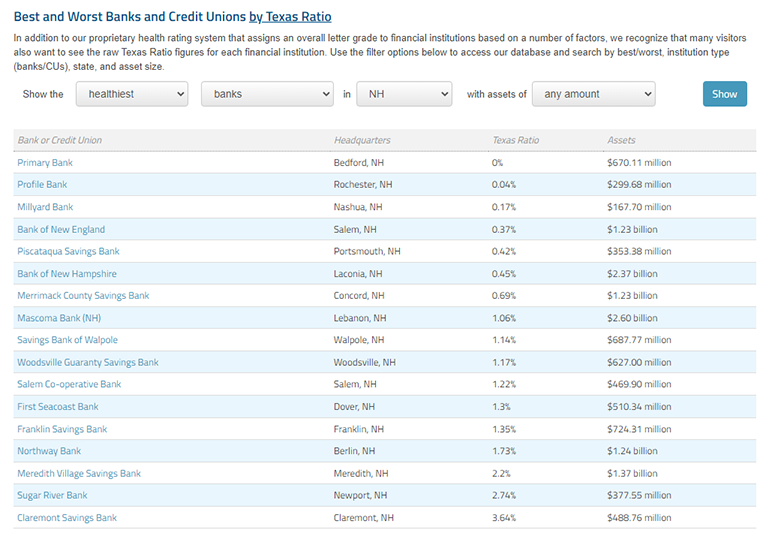

DepositAccounts.com evaluates the financial health of over 10,000 banks and credit unions in the United States. To determine bank ranking and recognition, DepositAccounts.com grades each institution on a number of factors, including capitalization, deposit growth, and Texas ratios.

The latest report from DepositAccounts highlights, once again, that Primary Bank is the healthiest bank in the State of New Hampshire, earning an A+ rating.

|

|---|

Have it All

When examining options for banking services to support the growth of your business, consider a bank that supports your community, builds trustworthy relationships, and provides clients with the security of strong financial health. Primary Bank is FDIC insured and an equal housing lender.

Consider the possibilities. Consider Primary Bank.